Cha-Ching™

Your money should work as hard as you do.

With ChaChing™ Checking, you’re not just getting a place to keep your cash—you’re unlocking a smarter way to save, spend, and thrive. This isn’t just a bank account. It’s your partner in progress, designed to help you build a brighter financial future without missing a beat.

With ChaChing™ Checking, you’re not just getting a place to keep your cash—you’re unlocking a smarter way to save, spend, and thrive. This isn’t just a bank account. It’s your partner in progress, designed to help you build a brighter financial future without missing a beat.

It's about your money. making money!

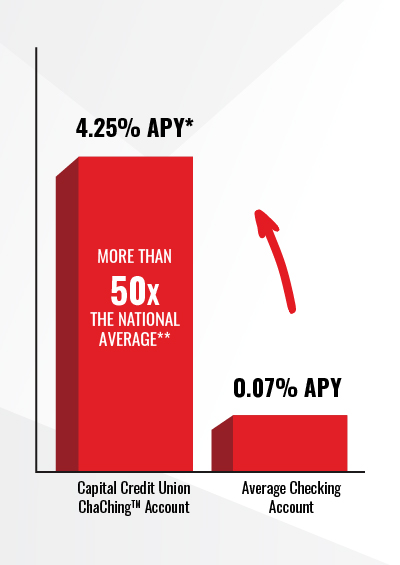

Check out why ChaChing™ is one of our most popular checking accounts that pays you back and helps you grow your money. Plus, start earning your 4.25% APY* and earn 50x more than the bank industry average.**![]() You are looking to get reimbursements on ATM fees.

You are looking to get reimbursements on ATM fees.![]() You are willing to enroll in direct deposit and receive eStatements.

You are willing to enroll in direct deposit and receive eStatements.![]() You are looking for an account that offers unlimited deposits and withdrawals.

You are looking for an account that offers unlimited deposits and withdrawals.

Earn more in a month, than you would in an entire year at most big banks.

| Average Daily Balance | Interest Earned After ONe Month | Interest Earned After One Year |

|---|---|---|

| $15,000 | $53.13 | $637.50 |

| $10,000 | $35.42 | $425 |

| $5,000 | $17.71 | $212.50 |

| $2,500 | $8.85 | $106.25 |

| $1,000 | $3.54 | $42.50 |

| $500 | $1.77 | $21.25 |

Note: Examples are approximate estimations and not based on compounding balances.

Not a member yet? You can open a savings account right along with a ChaChing™ checking account online.

Qualifying is Simple

Qualifying for your ChaChing™ perks. Simply do the following 3 things each monthly qualification cycle:Connect with us

*Annual Percentage Yield (APY) accurate as of Rates effective 2/1/2025. ChaChing™ Checking rate tiers are as follows: 4.25% APY applies to balances of $0.01 - $15,000 and 0.15% APY applies to balances over $15,000 if qualifications are met during the monthly cycle. No interest is earned if qualifications are not met. Rates and APYs may change after the account is opened and fees may reduce earnings.

**Comparison based on Capital Credit Union 4.25% APY as of Rates effective 2/1/2025 versus .07 the national average checking accounts that earn interest sourced from FDIC National Rates and Rate Cap as of 01/21/2025.

†0.50% loan discount on vehicle and personal loans requires an active checking account with at least $400 in deposits each month and 12 transactions of $5 or more during the month. $2,500 minimum new loan money or additional $2,500 to any existing Capital Credit Union loan required.

‡Qualifying purchase transactions must post and clear the account during the monthly cycle. Transactions may take one or more business days from the transaction date to post to an account from the date the transaction is made. Debit card purchase transactions can be made by signature or Point-of-Sale (using a PIN to make a purchase at a merchant).

Transfers between Capital accounts do not count as qualifying ACH transactions. Minimum to open account is $1. ATM fee reimbursements up to $10 provided only if qualifications are met within the monthly cycle.

Maximum of 2 ChaChing™ accounts per membership share.

**Comparison based on Capital Credit Union 4.25% APY as of Rates effective 2/1/2025 versus .07 the national average checking accounts that earn interest sourced from FDIC National Rates and Rate Cap as of 01/21/2025.

†0.50% loan discount on vehicle and personal loans requires an active checking account with at least $400 in deposits each month and 12 transactions of $5 or more during the month. $2,500 minimum new loan money or additional $2,500 to any existing Capital Credit Union loan required.

‡Qualifying purchase transactions must post and clear the account during the monthly cycle. Transactions may take one or more business days from the transaction date to post to an account from the date the transaction is made. Debit card purchase transactions can be made by signature or Point-of-Sale (using a PIN to make a purchase at a merchant).

Transfers between Capital accounts do not count as qualifying ACH transactions. Minimum to open account is $1. ATM fee reimbursements up to $10 provided only if qualifications are met within the monthly cycle.

Maximum of 2 ChaChing™ accounts per membership share.